Does Warby Parker’s Stock Price Reflect it’s True Value?

Sometimes, even if you do everything right, you get hammered. One thing is for sure, if you bought Warby Parker stock (NYSE: WRBY) at the $54.05 opening price on September 29, 2021, you might wish you didn’t see so well when you look at the $16.53 trading price today. Sometimes financial markets do not reward success regardless of happy customers.

When there’s a dramatic stock price erosion in a public company you wonder if the business model is failing or something else is going on. So, let’s look under the hood at Warby Parker.

The Business

In 2010, four Warby Parker co-founders, all UPenn Wharton classmates, decided to disrupt the eyeglasses industry by circumventing the traditional eye doctor/optometrist distribution channels. This meant overcoming a potentially strong cognitive dissonance if customers were leery of purchasing eyeglasses online. Warby Parker’s solution to changing consumer behavior was letting customers experience Warby Parker’s quality with a “touchy/feely” exposure to the product line by receiving customer selected trial samples at no cost or risk. It worked, and the company was off to the races…kind of.

Social Media at the Heart of the Plan

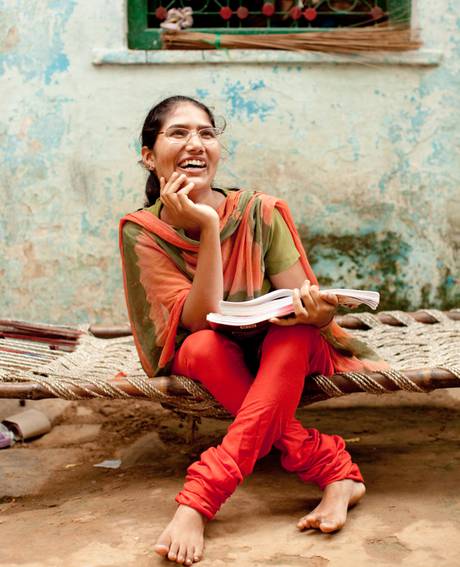

By understanding the importance of community, trust, and affirmative word-of-mouth, Warby Parker recognized the growing number of digitally native consumers who are more accepting of online purchases. Thus, Warby Parker set about developing a highly interactive social media relationship with its customers. The centerpiece is getting customers first to try the product, then relate their experiences through user generated social media content by posting pictures of themselves on Facebook, Twitter, and Instagram.

Thus, Warby Parker created a reinforcing customer community which went a long way toward overcoming the dissonance inherent to disrupting a business paradigm. It goes without saying that the company could never have built its sticky customer community by using traditional linear advertising. There would have been little or no feedback loop and scant affirmation of business model viability.

Keep ‘Em Informed, Tell ‘Em a Story

In any interpersonal relationship, it is desirable, if not fundamentally essential, for the parties to develop trust and an authentic appreciation for each other. Warby Parker doesn’t just sell eyeglasses. It tells stories and provides its user constituency and the market at large with educative resources to help customers address and overcome the challenges faced when buying eyewear. Again, social media comes into play because Warby Parker provides articles and YouTube videos addressing pertinent eye care topics interspersed with some fun influencer videos. Warby Parker thereby establishes authority and builds trust.

Do Well by Doing Good

As icing on the cake of customer engagement, Warby Parker recognizes the importance of social good as an element of authenticity that resonates with customers’ empathic sentiments. Warby Parker gives away a pair of glasses for every pair it sells. This transforms the relationship dynamics from simply commerce to shared enterprise, and it takes transactions beyond pure sales to the realm of participatory collaboration. It also uses storytelling to humanize the brand. This significantly reduces dissonance and enhances customers’ self-esteem in addition to giving them something to share with their social network communities. The net effect is viral word-of-mouth.

Who’s Disrupting Whom?

So, with all the good things happening at Warby Parker and strong customer loyalty, what about that pesky share price? A little perspective is warranted because timing is everything. When the company went public in September 2021, investors still had a pandemic mentality, i.e., there was a prevailing belief that everyone was going to stay in their homes forever. Thus, excessively high multiples were paid for companies seemingly able to reach customers without brick-and-mortar stores. The bloom has left that rose, and even Warby Parker is now in the brick and mortar business with over 200 retail stores nation-wide. Could the company actually be disrupting its own original model?

Numbers Tell Stories, And They Don’t Lie…Much

Financial analysts are back to looking at numbers and earnings. At the current $16.53 share price, the company’s P/E ratio is still a negative number. Social media isn’t going to solve that problem. The good news is, metrics are steadily improving. Any business doing $.75 billion in top line revenue must be doing something right. Overall sales revenues, number of customers, and per customer spend, are all in upward trends.

So Now What?

It seems, despite some hiccups along the way, Warby Parker’s business thesis remains relatively intact. Social media is deeply embedded into the company’s DNA, and its customer engagement and global community are vibrant and authentic. Consumer dissonance is largely overcome and continually addressed in the company’s marketing perspective. So now could be the time to improve our vision; maybe buy some eyeglasses and even nibble at a few shares of WRBY stock.

Landon Thorne on Sand Gnat Sound Bites

20 May, 2024 (C)

Leave a comment